November 2011 Newsletter

Since the crash of 2008 there have been many opinions offered as to how significant the correction in the construction industry will be and when it will return to the levels we enjoyed from 2004 to 2008. The short and factual answer is that the construction industry has taken its worst hit since the Great Depression. This hit has led to significant shifts in channel behaviors, which can be attributed to the evolution of the new economic landscape in the construction industry.

To put things into perspective, it is important to understand just how much the industry has constricted and how this ever-constricting market is impacting behavior in the AEC space. In 2006, residential construction spending reached its peak of $6.9 billion. Then, in 2007, the housing market started to show the results of the subprime lending practices of the past several years. We all know how this ended up playing out: with the world teetering on the edge of a global economic crisis at the end of 2008, mainly due to a massive housing and commercial real estate bubble.

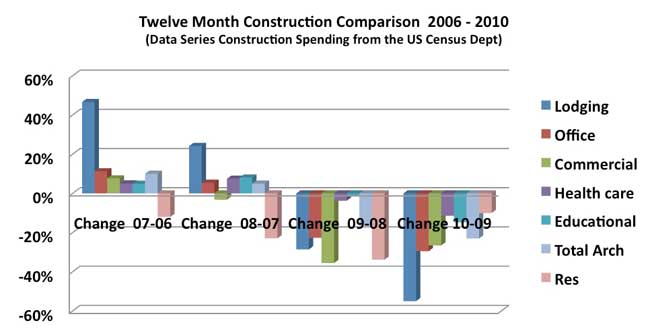

Residential construction continued to lose ground in 2008, ending at a total of approximately $2.8 billion, a staggering loss of over $4 billion. However, that was only the beginning. In 2009, the construction of commercial properties came to a screeching halt as property values dropped and banks found they were unable to lend due to the mounting toxic assets on their books. Below is a graph showing the decline in spending on residential, commercial and institutional buildings with a year-to-year percentage change.

Please note the steep declines in lodging, office, and commercial/retail for 2009, which further deepened in 2010. During 2009 the construction of healthcare and educational projects (the largest architectural sectors) held their own. However, as unemployment spiked to 10-plus percent in 2009, the reduction in income tax revenue left municipal, county and state funds stressed, which led to the gradual but prolonged slowdown in institutional construction. 2010 was the worst year for commercial and institutional construction spending, surrendering just short of $700 million compared to 2009, which was a bad 12-month stretch on its own, surrendering $695 million or 17 percent compared to 2008.

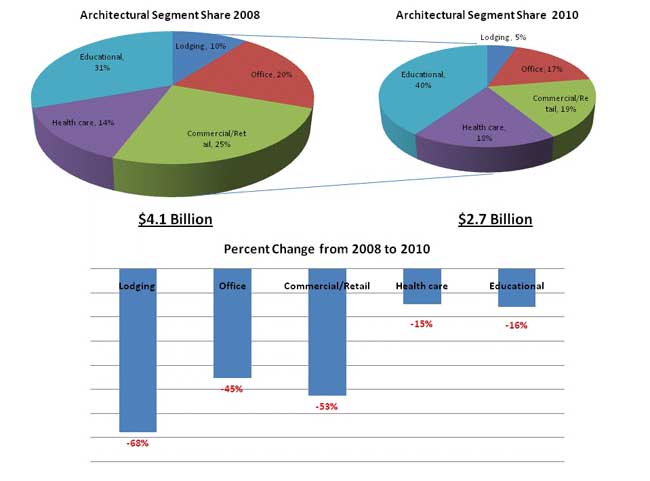

As illustrated above, the architectural market has lost thirty four percent since 2008. What is more, the pie charts show that the share of income properties (lodging, office and commercial/retail) dropped from 60% of total construction spending to only 40%, while institutional building (healthcare and educational) grew from 40% to 60% of total spending. Naturally, those serving the institutional market were impacted far less severely during this time than those focused on income properties.

Where We Are Related to 2006

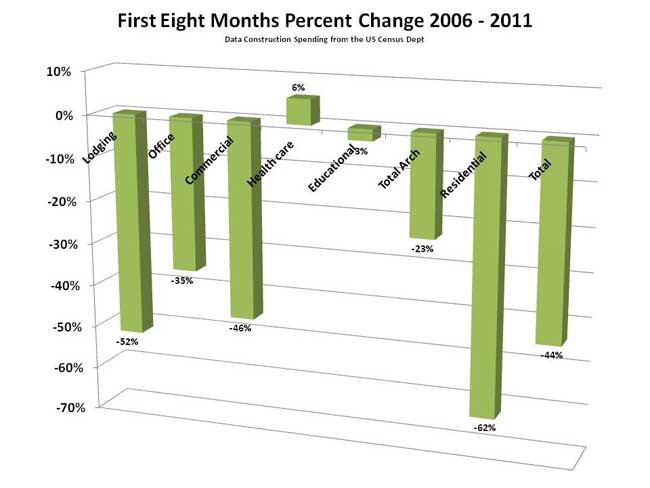

The chart below is comparing the percent change in construction spending with the first 8 months of 2011 with the same period for 2006. This is what I term a snapshot analysis; it is useful in product benchmarking and market analysis. This graph clearly illustrates how much value is still being lost through August of 2011. The exception would be 6 percent growth in the healthcare segment. Healthcare related products and services are one of the few areas that still continue to grow in the current economy and the construction of healthcare-related buildings is no exception. The largest segment of the US population is the Baby Boomer Generation, the group up of people born between the years 1946 and 1963. So the first phase of the Boomers will turn 65 in 2011, with an ever-increasing number to follow. In simple terms, there is not enough square footage in necessary healthcare-related buildings to serve this growing population. As a result, healthcare construction should remain a relative bright spot for years to come.

The other area on the graph that I should explain is residential. The US Census Department groups single family and multifamily construction into this single category, which ends up making (if you can believe it) the sector look healthier than it is. Due to our current employment struggles, the increase in home foreclosures and the difficulty in getting the necessary financing for single family homes, there is an ever-increasing demand for rental-related properties, especially apartments. For the purpose of this article, I have not broken out single family housing from multifamily, but the recent growth in apartment building construction means that the numbers for single family homes are actually much worse than the negative 62 percent would indicate.

Crystal Ball

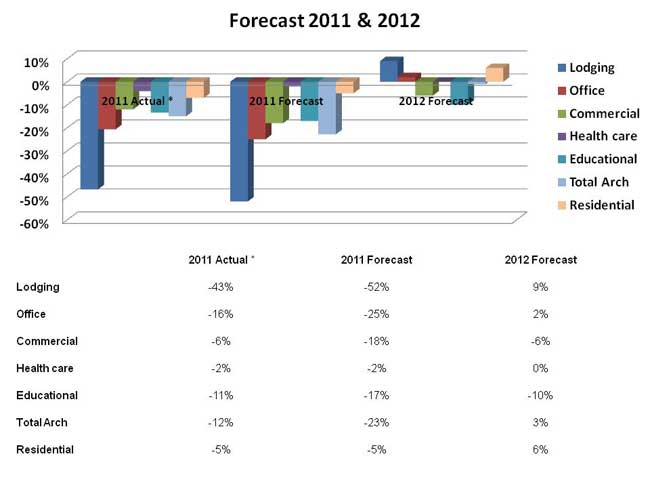

This graph is my forecast for the balance of 2011 vs. 2010 (September through December) and for all of 2012 vs. 2011.

Given the trend and current economic environment, I believe that income properties will lose more ground for the balance of this year and into the first quarter of 2012. However, I do feel that there will be a modest increase in demand for lodging and office buildings. Given the current unemployment and underemployment situation, I also feel that the commercial/retail sector is still grossly overbuilt, so demand will remain weak.

Healthcare will continue to slip more in 2011 with an increasing demand in 2012 for the reason I have mentioned earlier. Again, given the weak employment situation and shrinking tax coffers, including real estate tax revenues, and the resulting budget cuts, I feel the education sector will constrict for the balance of 2011 and 2012.

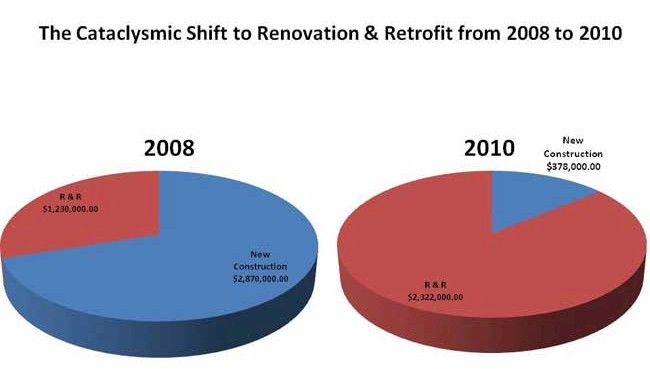

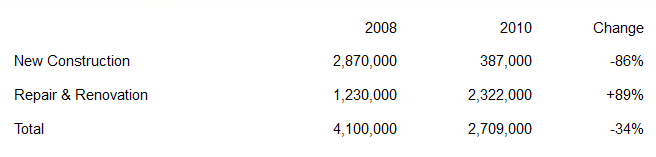

The most significant event in the contemporary construction economy is a monumental shift in new construction vs. renovation and retrofit (R&R). According to the April 2011 edition of Buildings Magazine and The American Society of Heating, Refrigerating and Air Conditioning Engineers (ASHRAE), eight six percent of construction spending was going to R&R, with only fourteen percent going to new construction/new square footage. I found this statistic staggering, however plausible, given the constriction in the marketplace. For verification, I ran these numbers by one of the country's leading industry economists, who confirmed that in his opinion they were more or less accurate. Historically, R&R is at most about thirty to forty percent of total spending, and the highest that I have ever seen it was roughly sixty percent. An increase in R&R is common when new construction slows; however having these numbers at more than 80% is very significant, and not likely to change anytime soon. This fact has, and will continue to, quickly and profoundly change the construction market landscape.

According to Kermit Baker, AIA's Chief Economist, architectural unemployment is at roughly 25 percent, and many of those architects lucky enough to still be working have taken significant salary reductions. This is quite plausible when considering that only 14 percent of architectural spending has any need for a full set of design and specification documents. Needless to say, this fact should be a "wakeup call" for those building product manufacturers who have traditionally spent a significant amount of their time, effort and budget marketing their products to the architectural community in order to become specified.

That being said, in my opinion a building product is not a true brand unless it is consistently specified; so it is important for manufacturers to maintain their architectural, as well as specifier, strategies and relationships. However, given the tremendous shift in the design and construction processes in this new construction market landscape, companies must drastically modify their channel strategies to include a much more intense focus on the contractor and design build community in order to remain viable.

Doug Bevill is president of Construction Economics & Strategies, a sales and marketing firm specializing in helping building product manufactures grow their businesses in the new construction market landscape. Prior to starting his own firm, Doug was with F.W. Dodge/McGraw-Hill Construction for 18 years, and also spent 8 years with The Hager Companies, a global manufacturer of residential and commercial door hardware, as Executive Vice President, Chief Operating Officer and Chairman of Hager Asia.

--------------------------------------

Colin Gilboy

Publisher - 4specs

Contact us